The future of payments is invisible

Nobody wakes up thinking about how they’re going to pay today. And yet payments technologies are central to the modern economy; we use them everyday. Payments technology impacts how we spend, where we spend and how much we spend.

Consider online shopping carts - there is a tension between real usefulness and being an obstacle to transacting. On the one hand, merchants want to make it as easy as possible for customers to checkout. However, making it too easy can result in confused customers ordering before they’re ready. This tension has defined payments trends for the past 20 years and can be summed up as: be as frictionless as possible, but no more frictionless than that.

Today, frictionless means one-click checkout online and tap-to-pay in-store. But frictionless is fast evolving toward invisible. The future of payments is invisible.

The trend toward invisible payments is the natural conclusion to the convergence of four key technology trends.

The trend of reduced friction in digital payment flows; reduced friction is good for business and consumers seek it out.

The trend toward convenience; manifesting itself in subscriptions and the on-demand economy.

The emergence of natural interfaces like voice and computer vision that are built on a backbone of AI.

All of this builds upon a fourth trend toward automation, stacked on an IoT sensor layer and accompanying AI.

Combined, these trends point to a future where consumers interact less at checkout and make fewer explicit payment decisions.

This is true for interfaces generally. As the godfather of Human-Computer Interaction Don Norman puts it “I don’t want to focus my energies on an interface. I want to focus on the job…I don’t want to think of myself as using a computer, I want to think of myself as doing my job.” And so too for payments. The best payment interface is no interface.

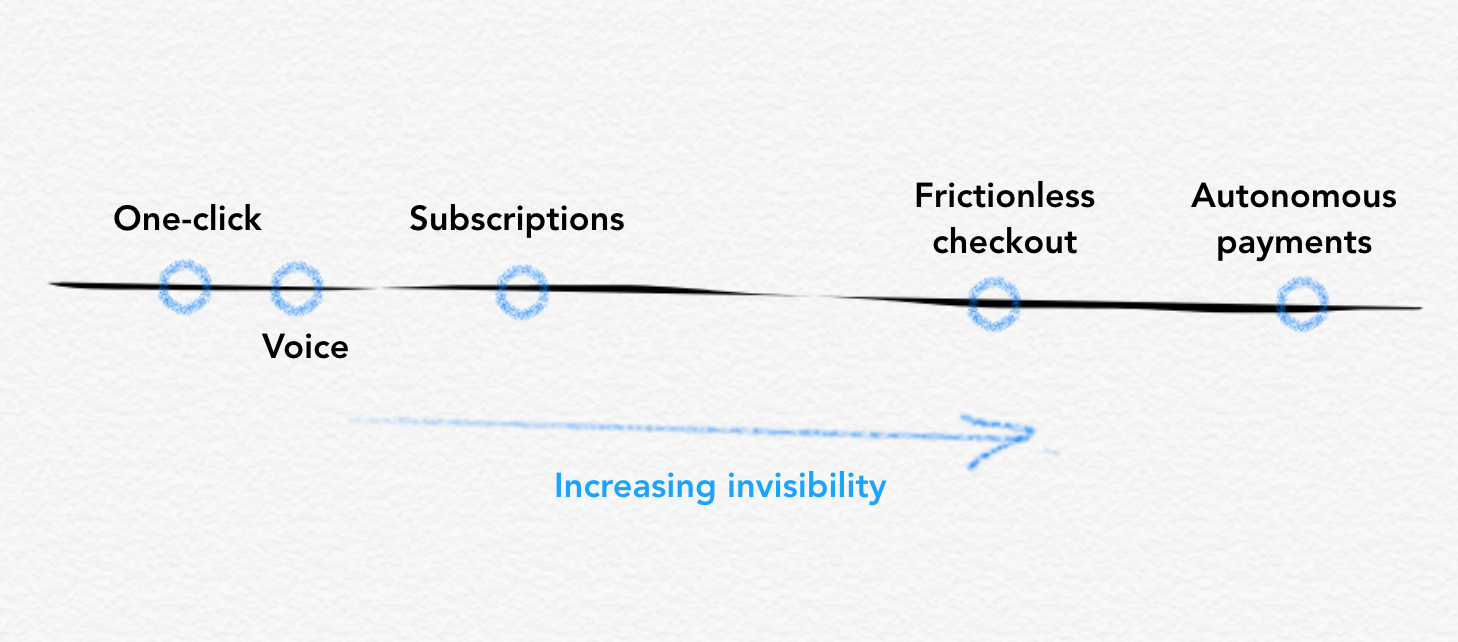

Invisibility can be thought of as a spectrum. From less obtrusive to truly invisible. Some emerging interfaces enable more seamless payments, others require it.

Invisible, explicit.

On the not-quite-invisible end of the spectrum is a collection of frictionless payment types. Online one-click (think Amazon) and physical one-click (think Flic, or the discontinued Amazon Dash) make it as easy as possible to checkout, while still explicitly deciding to pay. This trend to one-click checkout is taken a step further by Uber who combine the ‘buy’ command and ‘hail a car’ command. It’s a natural action the user needs to take - there is no need for the distraction of checkout flows. Whatever attitudes towards Uber generally, the ease of use of their app is widely lauded by consumers.

Subscriptions, the original invisible payments, continue to grow. We’re all familiar with subscriptions for utilities, television and newspapers. But subscriptions have a long and interesting history. Book publication was the first enterprise to use subscriptions as a business model; Minsheu's Ductor in linguas (1617) was the earliest subscription volume. Translations of Paradise Lost and Virgil soon followed. Insurance companies likewise started as subscription ventures. In 1638 Charles I granted a patent for a fire-insurance organisation with financed by voluntary subscriptions. Subscriptions even made their way into education as early as a 1693 geography course in England.

If you’re reading this, odds are you have digital subscriptions - Netflix or Prime, Spotify or Apple Music. The 2010s saw subscriptions migrate to physical products. Dollar Shave Club, BarkBox, Birchbox, HelloFresh, StitchFix are stamped on millennial bank statements in the same way a trip to Home Depot lights up a Boomer credit card.

At its core, a subscription is a one-time payment decision to pay regularly. Set it and forget it. It’s a commitment on behalf of your future self and an understanding that the merchant or brand will fulfil their promise. Subscriptions suit business planning, and suit millennial commitment to access over ownership. Subscriptions are invisible and will continue to grow.

Voice transactions are unseen, but explicitly invoked by users. Voice commerce is growing rapidly from a small base. For users it requires developing new mental models; we’re used to talking but we’re not quite used to navigating a checkout flow without a screen or cashier. Voice is inherently suited to transactions where you’ve bought the item or service before (order my usual coffee), where the product catalogue is small (pizza) or where customisation is minimal (milk).

Computer vision brings invisible payments to brick-and-mortar. Here, the payment decision is bundled with leaving the store. You leave with it, you bought it. Amazon Go, Walmart and Alibaba each have flagship stores. Startups operating in the space (Standard Cognition and BingoBox) aim to make this accessible for smaller merchants.

These forms of invisible payments are a big departure from a world where consumers closely guard their spending and hawkishly monitor the checkout flow to conversion. If online commerce was a battle to get users to trust this new medium, invisible commerce is a campaign to get users to relax their control over payments. For any previous generation this would be unthinkable. For a generation hooked on convenience and that grew up trusting online commerce, it is a match made in Big Data heaven.

Autonomous payments.

The pinnacle of the invisible trend is autonomous payments. Here, decisions are made on behalf of the user. These can be trigger-based (e.g. when you pass a road toll, enter a nightclub, or run out of milk) or assistant-based (predictive re-supplying of your fridge, predictive sending of new outfit).

To consumers, this is packaged up as personal digital assistants. In these scenarios, we imagine that we have an assistant who works away in the background ‘taking care of business’, paying bills, negotiating, making smaller decisions that best suit our tastes. The assistant’s objective is to ensure that business runs smoothly, with minimal interruption for the user; but is aware that at times will need to ask the user for clarification, or direction.

This is a big departure from the other types of invisible payments; a fundamental shift in how consumers think about shopping. Whereas frictionless payments mean consumers relax their involvement in the payment process, autonomous payments have consumers relinquish the decision-making entirely. That, on the face of it, is a scary proposition. Why would consumers ever agree to this? In many ways, it's a response to decision-fatigue. Autonomous payments offer a welcome respite from the relentless decision-making that has accompanied the financialisation of everything. The 'no interface' trend promises the removal of the mental, emotional clutter of buying by having your wishes compressed and satisfied.

Invisible infrastructure

Artificial intelligence (AI) is central to invisible payments. Removing complexity from the user requires the product or service to do more in the background; to do this work in a precise, automated way is the role of AI. Underpinning all of this are assumptions that an existing layer of payments handling takes place in the background. From a payments-perspective, interacting with no interface means payment is taken care-of in the background with no, or minimal interaction of the user during purchase.

Where do you want your automation

Not everyone wants automation in their buying decisions; today, most consumers are unaware of frictionless checkout and autonomous payments. Control over our purchases, is a well-worn habit and won’t be given up lightly. Those that do embrace full invisible automation, won’t want it in all their spending categories. Likely, invisible payments will begin with small transaction amounts and convenient use-cases or in scenarios where the AI can be trusted to do things better than we do them ourselves (e.g. StichFix’s outfit curation).

As with current payment modes, there exists a trade-off between convenience and trust. Feeding into both is a technological and experience threshold above which the user perceives the benefit of low-interaction modes and trusts that the technology will work in a way that is secure and straightforward. The key question, what is the optimal payments interface for a user in a given context; it will be frictionless, and soon it will be invisible.

— —- —